Cracking the Code: How Manchester City F.C. managed to break into the Premier League Elite

Chapter 6: Elasticity of demand

Feehan et. al (2003) argues that the Premier League is to be considered a normal rather than an inferior good. This means that the demand of the products of the Premier League is elastic to the income of the consumers and will increase when there is an increase in the consumer’s income or an expansion of the economy.

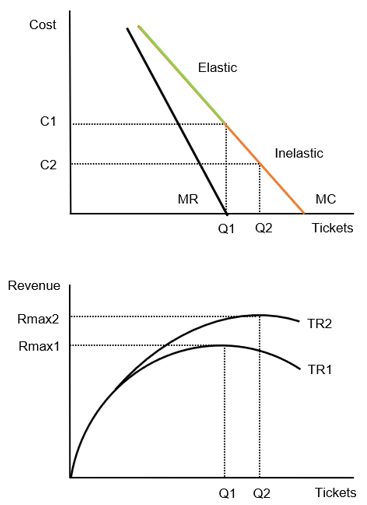

Fort (2004) on the other hand advocates that empirical studies documents the inelasticity of demand for tickets at sport venues (Q2, C2 in figure 8). This is seen as a paradox (Porter, 2007) as football clubs can operate close to a monopolist towards their fan base and therefore should be able to set marginal revenue equal to marginal cost to maximise profit (Q1, C1).

Figure 8: Paradox of ticket price inelasticity of demand

Setting ticket prices lower than needed must be seen in relation to the matchday revenue becoming less important to the clubs compared to broadcasting and commercial income.

Clubs want to increase their fan base to become more attractive and lowering ticket prices to sustain and attract more supporters through broadcasting is one measure.

Having a full stadium with active supporters adds to the value of the product. In addition, revenue from complementary goods sold on matchday adds to the ticket sales and is shown at the bottom graph in figure 8.

Sales from replica shirts, food, hospitality, and other matchday entertainment services increases revenue from Rmax1 to Rmax2 and is another possible reason why matchday tickets prices are kept in the inelastic region (Lenten, 2012).